Chưa có sản phẩm trong giỏ hàng.

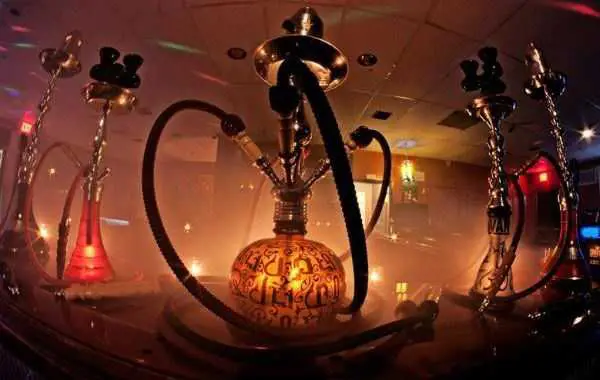

Tại sao nên mua shisha của Hookah Shisha Kim Mã

![]() Hookah Shisha Kim Mã-Công ty MeaDow là đại lý của các công ty kinh doanh shisha như Alfakher,Adaylia…

Hookah Shisha Kim Mã-Công ty MeaDow là đại lý của các công ty kinh doanh shisha như Alfakher,Adaylia…

![]() Uy tín khi bán các sản phẩm bình,thuốc,than,thuốc lá điện tử,vape,pen

Uy tín khi bán các sản phẩm bình,thuốc,than,thuốc lá điện tử,vape,pen

![]() Hoàn tiền 100% nếu khách hàng không hài lòng về sản phẩm

Hoàn tiền 100% nếu khách hàng không hài lòng về sản phẩm

![]() Chúng tôi có chi nhánh tại Hà Nội và Tp HCM dễ dàng vận chuyển toàn quốc

Chúng tôi có chi nhánh tại Hà Nội và Tp HCM dễ dàng vận chuyển toàn quốc

-4%

Bình shisha

Original price was: 1.400.000₫.1.350.000₫Current price is: 1.350.000₫.

-14%

Bình shisha

Original price was: 1.100.000₫.950.000₫Current price is: 950.000₫.

-17%

Bình shisha

Original price was: 1.200.000₫.1.000.000₫Current price is: 1.000.000₫.

-4%

Bình shisha

Original price was: 1.350.000₫.1.300.000₫Current price is: 1.300.000₫.

-12%

Bình shisha

Original price was: 1.250.000₫.1.100.000₫Current price is: 1.100.000₫.

-9%

Bình shisha

Original price was: 1.150.000₫.1.050.000₫Current price is: 1.050.000₫.

-10%

Bình shisha

Original price was: 1.050.000₫.950.000₫Current price is: 950.000₫.

-13%

Bình shisha

Original price was: 1.150.000₫.1.000.000₫Current price is: 1.000.000₫.

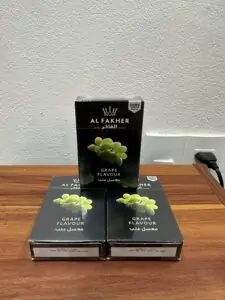

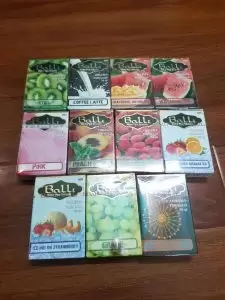

Thuốc shisha

80.000₫

Thuốc shisha

-13%

Thuốc shisha

Original price was: 80.000₫.70.000₫Current price is: 70.000₫.

Thuốc shisha

70.000₫

Than shisha

280.000₫

Than shisha

220.000₫

Than shisha

200.000₫

Than shisha

120.000₫

-25%

Phụ kiện shisha

Original price was: 200.000₫.150.000₫Current price is: 150.000₫.

Phụ kiện shisha

50.000₫

Phụ kiện shisha

40.000₫

Phụ kiện shisha

35.000₫

KẾT NỐI VỚI CHUNG TÔI

PHẢN HồI VỀ HOOKAH SHISHA

Tổng quan về quỹ đầu tư (investment fund )Hookah Shisha Kim Mã

Hookah Shisha Kim Mã– thương hiệu của Công ty MeaDow hiện là một trong quỹ đầu tư các sản phẩm hỗ trợ cai thuốc lá.Có tiền thân là quỹ đầu tư cho dự án âm nhạc The Wind in the Willow (public investment fund for a new musical adaptation of The Wind in the Willows ) của Jamie Hendry nhằm mục đích nâng cao chất lượng nhà hát West End, London,Vương quốc Anh.Website investinwillows.com được ra đời nhằm mục đích thu hút gây quỹ trực tuyến cho dự án âm nhạc The Wind in the Willow.Website đã tạo ra 1 bước đột phá lớn cho sự thành công của quỹ đầu tư âm nhạc của Jamie Hendry.Sau sự thành công vang dội của dự án âm nhạc.Website investinwillows.com đã được chuyển đổi mô hình sang quỹ đầu tư cho các sản phẩm cai thuốc lá hiệu quả với thương hiệu Hookah Shisha Kim Mã.Chúng tôi cung cấp các sản phẩm thuốc lá điện tử (vape,Iqos,zero…) và bình hút shisha (bình shisha,thuốc shisha…).Xem thêm tại giới thiệu về Hookah Shisha Kim Mã.